$ZS and $CRWD Earnings Recap

ZS 0.00%↑ delivered very solid results, growing topline by 40% compared to consensus of 33% and Billings by 34% surpassing consensus of 30%, however, this growth fell slightly short of the higher buyside expectations, which were in the mid to high-30% range. The company's operating profit and FCF more than doubled year-over-year, with a record free cash flow margin of 45%. ZS continued to exceed the rule of 60 for the 13th consecutive quarter, showcasing a unique combination of high growth and profitability. Record performance in the U.S. federal sector, with new business growing over 90% YoY as the focus on Zero Trust security in response to the President's executive order was a significant contributor. They achieved a record number of large new logo wins in the first quarter, with 14 new logos each contributing over $1 million in ARR, brining the total count to 468, marking a 34% increase YoY. Nearly half of the new logo customers opted for all three key user pillars offered by ZS: Zscaler Internet Access (ZIA), Zscaler Private Access (ZPA), and Zscaler Digital Experience (ZDX). Upselling within the platform continues to be strong with DNBR coming in at 120%. The company has increased its revenue guidance to be in the range of $2.09 billion to $2.1 billion, representing 30% YoY increase. Calculated billings are expected to be in the range of $2.52 billion to $2.56 billion, representing 24-26% YoY growth. While billings beat in 1Q they decided to leave FY guide unchanged and err on the side of conservatism given they are onboarding a new CRO, Mike Rich, which could create some near-term GTM disruption. FY operating profit is expected to come in at $360-$365M, reflecting a 250bps margin improvement. Data center CapEx is projected to be a high single-digit percentage of revenue for the full year, representing a 3-4 percentage point headwind to FCF margin, which is expected to come in at low 20% range.

Zscaler has begun to see success in acquiring customers who initially opted for firewall-based single-vendor SASE solutions but were dissatisfied with the real-world performance of these solutions. Traditional firewall-based SASE solutions offered by the likes of PANW 0.00%↑ integrates SD-WAN, firewall, and VPN as VMs in the cloud. The customer found the firewall-based solution to expand the attack surface and increase the risk of lateral threat movement, leading the customer to choose ZS's Zero Trust security. The customer purchased the complete bundle for all 25,000 employees, including ZIA, ZPA, and ZDX. Zscaler's Zero Trust Exchange connects users directly to applications, eliminating the attack surface and preventing lateral threat movement. Another example was a hospitality and gaming company (Ceaser/MGM), after suffering a ransomware breach despite having firewalls and VPNs, opted for Zscaler's services for 25,000 users. Their applications are now hidden from potential attackers and protected against discovery, exploitation, or DDoS attacks. For unmanaged devices, the customer deployed Zscaler's browser isolation with ZPA, allowing third-party access to their applications securely. Zscaler is increasingly being chosen over traditional firewall-based SASE solutions due to its superior security capabilities, particularly in the realm of Zero Trust architecture. This shift is evidenced by significant new customer acquisitions and upsells, where Zscaler's platform has successfully addressed complex security challenges and reduced organizational risk. Traction with new offerings such as Risk 360, which closed 10+ deals with 6 figure ACV, is an encouraging sign as they broaden their platform offering. They introduced new Advanced Plus bundles featuring AI-enhanced data protection policies and tools which have an ASP that is 20% higher compared to Transformation bundles. The company aims to leverage its data protection capabilities to secure the usage of genAI technologies, such as providing DLP protection for inputs into systems like ChatGPT.

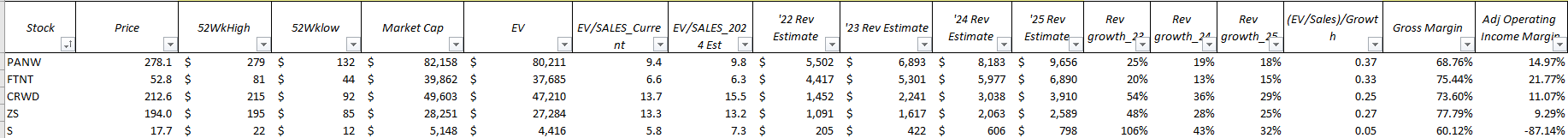

Overall, ZS had a very strong quarter as they continue to expand their customer base with significant new contracts and enhancing revenue from existing customers, reflecting the company's robust market position and compelling value proposition in its SASE offering. Their strategic focus on integrating advanced AI capabilities into its security products, enhancing their value proposition, and addressing emerging security challenges in the rapidly evolving digital landscape will continue to payoff for years to come. The introduction of the Advanced Plus bundles and the early success of Risk 360 indicate strong market demand for AI-driven security solutions and Zscaler’s ability to capitalize on this demand. Shares are trading inline with CRWD 0.00%↑ on EV/S basis, with CRWD exhibiting more mature financial profile with higher FCF margin, while ZS has the potential to capture a larger share of the cyber security market if they are able to emerge as the de facto SASE solution. Valuation seems reasonable given the level of execution and potential for topline to CAGR at over 20% for the next decade but any short term hiccups will cause shares to get hit hard given the premium multiple.

CRWD 0.00%↑ reported good results as well with NNARR growing 13% YoY which was well above the 6% sell side consensus but inline/slightly lower with the buyside bogey. This growth is attributed to the increasing demand for CrowdStrike's AI-native XDR platform and higher win rates against competitors. Total ARR was $3,152M, up 35% YoY. FCF margin came in at just over 30%, producing $239M of FCF for the quarter. Raised FY topline guidance to $3,049M, representing 36% YoY growth. Operating income raised to $635M from $606M, representing a 21% margin. Module adoption rates continue to increase with 63% of subscription customers have adopted more than five cloud modules, 42% over six, and 26% over seven compared to 60%, 36% and 21% last year. Surpassed the $3 billion ARR milestone, reaching $3.15 billion, a 35% year-over-year growth. This achievement makes CrowdStrike the fastest and only pure-play cybersecurity software vendor to reach this milestone. Partnerships with the likes of ZS 0.00%↑ and other continue to payoff with 62% of new logo wins being partner-sourced while surpassing $1 billion in AWS Marketplace sales, a first for a cybersecurity vendor.

On the call George spoke about some of the growth areas and how LogScale can help them disrupt the SIM market by addressing common industry complaints such as complexity, integration challenges, scalability issues, alert fatigue, and slow response to new threats. Its petabyte-scale logging capability, combined with an index-free architecture, tackles scalability and data management challenges head-on, enabling organizations to handle vast amounts of data efficiently. The real-time search and visualization features, alongside a user-friendly interface, significantly reduce the complexity and usability issues often associated with SIM solutions. Furthermore, LogScale's comprehensive visibility, advanced query capabilities, and robust access control mechanisms directly address integration challenges, alert fatigue, and security concerns. DLP is another growth area (ZS called this out as well) where Falcon Data Protection could revolutionize the Data Loss Prevention market by making it easier and more effective. It combines monitoring of sensitive data with real-time detection to prevent data theft. The platform is easy to set up, merging data protection with regular security in one simple package. This reduces cost and complexity. It's particularly good at stopping data leaks from new technologies like AI tools, while ensuring rules are followed across different channels. Its unique features allow companies to customize protection and understand data movement better.

In today's digital landscape, no organization is scaling back on cybersecurity spending, instead, there's an increased emphasis on robust, integrated solutions. CRWD's platform, exemplified by its comprehensive suite of tools and the recent Bionic acquisition, directly aligns with this trend. Their focus on innovation has led to a robust platform that simplifies cybersecurity, integrating everything from cloud identity to next-gen SIM products like LogScale. Their growth is evident, with a notable 45% increase in public cloud customers. The acquisition of Bionic further positions them as a comprehensive solution provider under one umbrella. CrowdStrike's ability to consolidate the cybersecurity market, exemplified by products like Falcon Go, shows their commitment to making advanced security accessible to all business sizes, further reinforced by their strong partner ecosystem and leadership in the market.

In terms of valuation, my view on CRWD is similar to ZS in that the premium valuation is worth it given the secular tailwinds and ever increasing emphasis on cybersecurity. While the stock has doubled YTD, at 30x ‘26 FCF the valuation is reasonable, especially considering the parallels to PANW’s evolution into a platform story a couple of years back. The company's diversified ARR sources and consistent GAAP profitability further bolster this outlook. Key factors like its dominance in endpoint security and the strategic Bionic acquisition add layers to CRWD’s growth narrative.