Why Gross Margins Matter: The Secrets Behind Software Company Success

Introduction

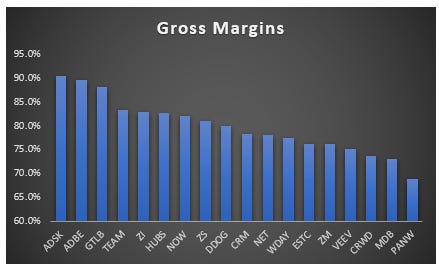

Today, we're going to dive into the fascinating world of gross margins and why they matter, especially when it comes to software companies. In the software realm, gross margins often reign supreme and are the superheroes of profitability. The RBC Software Index, where the average gross margin stands tall at 77%, towering over the S&P 500's modest 48%. Gross margins, combined with factors like growth, recurring revenue models, and economic resilience, justify the sky-high valuation multiples bestowed upon software companies. They are one of the driving forces behind a company's journey to profitability. Think of them as a top-tier player in a grand orchestra of success. Why are high gross margins such a big deal? Well, they act as superheroes with deep pockets. Imagine a newly-minted software IPO, determined to achieve 20%+ operating margins, even if they're not quite there yet. Having strong gross margins makes this journey a whole lot smoother.

Let's break it down: Suppose a software company boasts a splendid 80% gross margin. They can afford to spend 50% of their revenue on research and development (R&D) and sales and marketing (S&M), while still comfortably reaching that magical 20% operating margin target. Now, let's contrast that with a company flaunting a 60% gross margin. They'll need to tighten their belts a bit, allocating only 30% of their revenue to R&D and S&M to reach the same operating margin goal.

Factors That Drive Gross Margins: The Nuts and Bolts Explained

Revenue Mix: SaaS companies divide their revenue between subscription and professional services. Subscription revenue, which includes licenses and support, tends to have higher gross margins than professional services. Think of professional services as the hands-on, people-intensive side of things like customization, implementation, and training. Generally, companies with higher subscription revenue enjoy higher overall gross margins. Trends in gross margins can give us insights. Falling subscription gross margins might indicate pricing pressure, while rising margins suggest a favorable pricing environment or a shift toward premium subscription plans.

Product Mix: The mix of different products within a company's portfolio can significantly impact overall gross margins. Some products may have higher margins, while others drag them down. For example, as a company focuses more on its high-margin products, overall gross margins improve.

Cloud vs. On-Premise: Here's a battle of infrastructure. On-premise solutions generally boast higher gross margins because they don't have infrastructure costs. On the other hand, SaaS companies have lower overall gross margins. If a company follows a hybrid deployment model, where they offer both cloud and on-premise options, a growing cloud mix can put pressure on gross margins. On the other hand, SaaS tends to bring in higher gross profit dollars compared to on-premise solutions.

Free Users and Free Trials: Companies with a significant number of free users may experience pressure on their gross margins. However, it's important to note that companies account for the cost to support free users differently. Some, like ZM, consider it a cost of revenue, while others, like NET, categorize it as sales and marketing.

Geography: Generally, gross margins should be consistent across international markets and the United States, unless a company is offering significant discounts internationally. However, there are situations like TWLO, where international operations carry significantly lower gross margins. This aspect has been part of the ongoing debates about the company's stock.

Pricing Tiers: Many SaaS companies offer tiered pricing, with entry-level and premium options. Having a higher mix of customers opting for the premium tiers tends to be a tailwind for gross margins. It's like when you choose the deluxe package of a streaming service—it comes with extra perks and helps the company's bottom line.

Pass-Through Revenue: In some cases, certain revenue is effectively at a 0% gross margin and weighs down overall gross margins, even if it doesn't impact overall gross profit dollars. For example, TWLO's messaging business includes a carrier fee, which is usually a pass-through cost.

Capital Intensity: Some businesses, like those in the infrastructure realm, require significant capital investments. These capital-intensive businesses tend to have lower gross margins, mainly because a chunk of their depreciation and amortization expenses flows through the cost of revenue line item.