ROKU 2Q Results

Roku reported results that beat analyst estimates and had bulls cheering the return to growth. Many bulls point out the solid growth in active accounts and streaming hours which in theory should lead to revenue growth in the future. While Roku has established itself as the leading TV streaming platform in the U.S., its ability to effectively monetize this position remains uncertain. A key issue is that much of the time spent on Roku devices is on third-party streaming services like Netflix, YouTube and Disney+ where Roku's monetization is limited. Roku generates revenue primarily from ads on The Roku Channel and cuts of subscription fees, but ad spend on The Roku Channel likely represents a small portion of overall ad budgets given its limited content offerings and lack of premium video inventory.

Additionally, Roku lacks the same ad targeting and frequency management capabilities as some competitors. For example, Roku cannot easily cap ad frequency or target ads against specific content like Stranger Things on Netflix. This makes Roku's ad inventory less valuable to brands compared to streaming services or traditional TV networks. While Roku has scale in accounts, its position in the ad market appears more vulnerable relative to streaming leaders like Netflix and YouTube.

Overall, Roku's large user base does not directly translate into a strong monetization engine. The company may struggle to significantly expand its ad business without more premium video inventory and better ad capabilities. This could limit revenue growth and profitability over the long-term.

While Roku's ad business faces limitations, the company has been making moves to open up its platform and bring in more ad demand. On the call they emphasized their intention of integrating with major third-party DSPs like TTD to allow ad buyers to directly target Roku's audience and buy its inventory programmatically. This could help attract new ad budgets from brands and agencies that want to reach Roku's large user base but previously found its advertising options limited.

Roku needs to move away from a "walled garden" approach and giving marketers more robust tools to measure and manage ad campaigns across both Roku and other channels. If Roku can back up its audience scale with greater flexibility and measurement capabilities, it may be able to strengthen its positioning in the TV and streaming ad market. Jeff has been on the mark in terms of the strategies that will succeeded within CTV, and it’s not the walled garden approach.

The real test will be whether Roku can translate those technical improvements into ad revenue growth. But by tearing down some of the proprietary barriers around its platform, Roku has potential to better monetize its strong user penetration and turn its technical footprint into an advertising one. Execution remains key, but the company appears to be evolving its ad business in the right direction to address concerns around its monetization path.

One promising area for Roku could be leveraging its platform to enable more direct-to-consumer shopping and transactions through CTV advertising. Roku's shoppable ad formats allow viewers to seamlessly purchase featured products through their remote control or Roku mobile app, with payment details already stored in their Roku account.

Given Roku's scale, these shoppable ads and streamlined buying experiences on the TV screen have major monetization potential as commerce steadily shifts to CTV and Roku could take a cut of any transactions made through its platform. While still early stage, Roku is in a unique position to reduce friction and connect ad exposures with purchases among its large user base.

If Roku can build on its initial shoppable ad efforts, commerce-driven advertising could emerge as an important incremental revenue stream over time. This would further diversify Roku's business beyond just capitalizing on ad impressions and unlock new monetization paths tied to its strong footprint in TV streaming and payments. Execution remains key, but shoppable ads represent an intriguing opportunity for Roku to drive higher-value ad inventory. The trend towards shoppable/direct-to-consumer ads on CTV appears poised to accelerate, and Roku could be a leader in that shift.

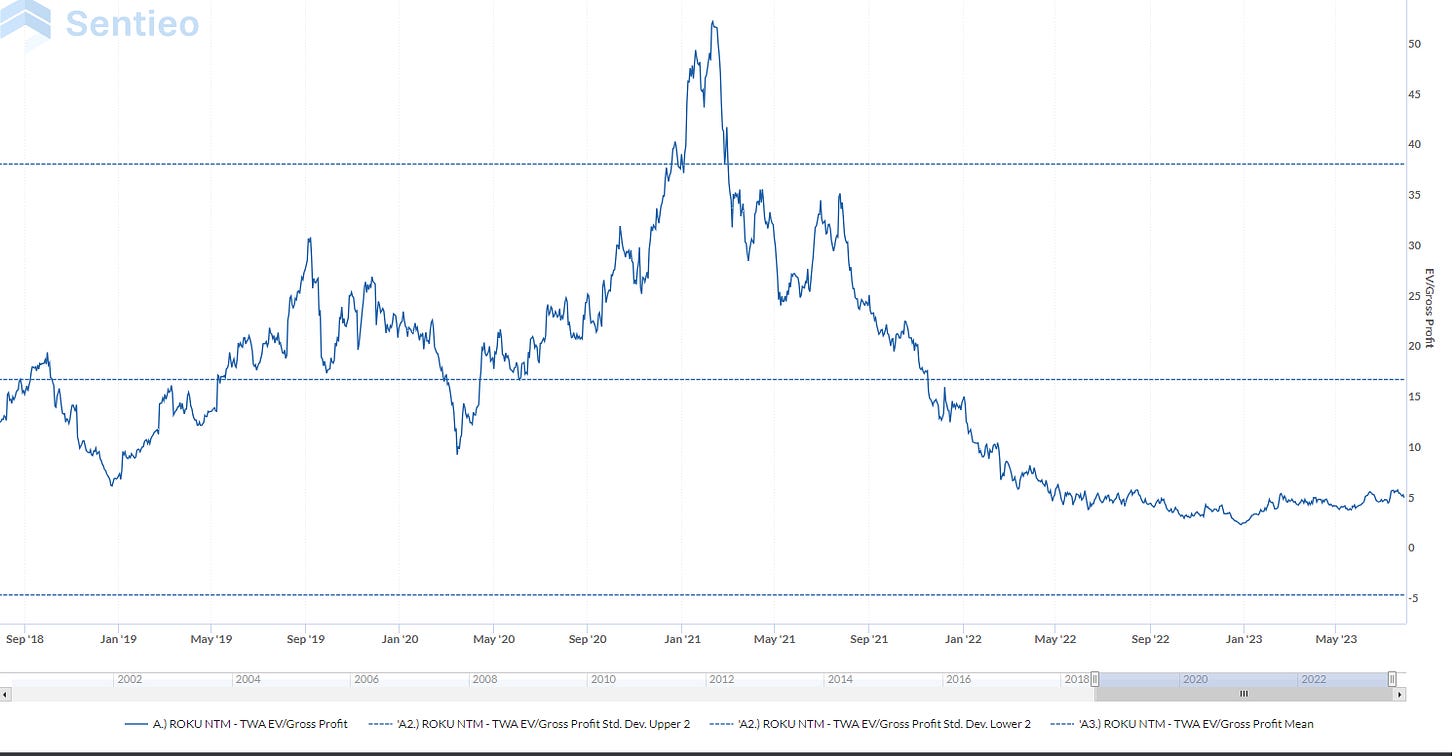

At around $11 billion enterprise value and 7.5x gross profit, Roku's valuation reflects significant uncertainty around its growth outlook. However, there are factors that suggest a potential path for Roku to improve monetization of its leading streaming platform, if execution goes well.

On the positive side, Roku maintains an immense footprint of over 70 million active accounts in the U.S. streaming market. Its operating margin should also benefit from recent cost discipline, although the sustainability of that is questionable. Additions of key executives and a new CFO could bring needed strategic changes too.

However, Roku faces real challenges maximizing ad revenue from its strong user base. Building out its ad capabilities and attracting bigger ad budgets will require ongoing platform investment and take time to materialize.

Revenue grew 11% YoY to $847M. Platform revenue beat and was up 11% to $744 million. Device revenue grew 9%.

Active accounts reached 73.5M, up 1.9M from Q1.

Streaming hours were 25.1 billion, up 21% year-over-year.

Gross profit was $378M, up 7% year-over-year. Platform gross margin was 53%, down 3 percentage points but up sequentially.

Roku OS was #1 selling smart TV in U.S. and Mexico. Roku Channel now reaches 3% of U.S. TV streaming.

M&E and scatter ad demand remains pressured, but seeing recovery in areas like CPG and health/wellness.

Slowing OpEx growth ahead of forecast, expects growth below 5% in Q3 and further improvement in Q4.

Early days with third-party DSPs but seeing incremental budgets and long-term potential.

ARPU dropped 7% year-over-year to $40.7 due to platform revenue growth slowing while active accounts continued growing quickly.

Has pulled back from some international markets like Europe in the past year, but they are still seeing good traction in core international markets like Canada, Mexico, and Brazil.

Did not break out any specific international metrics indicating international is still likely a small contributor.

Guidance

3Q revenue guidance is $815M, up 7% year-over-year. Gross profit $355M, gross margin 43% and adj EBITDA loss of $50M.

Expect platform revenue growth to remain pressured by weakness in ad spend, especially in media/entertainment due to limited fall release schedules.

Committed to achieving positive adjusted EBITDA for full year 2024 with continued improvements after that.

Third Party DSPs:

Recently started more actively engaging with third party DSPs to open up incremental ad demand.

It's still early and off a small base, but is seeing new budgets that they weren't accessing before.

Over time believes relationships with third party DSPs have significant long-term potential.

Ensuring demand from third party DSPs is additive and not cannibalizing existing ad business.

They are seeing positive signs and account growth from third party DSP relationships so far.

Shoppable Ads:

Launched shoppable ads that allow viewers to purchase products directly on the TV.

Early partners include True Classic, ConnectedFit, and wellness brands.

Still early days in teaching consumers to shop on TV like they do on phones.

Positive early signs but will take time for consumers to adopt shopping on the TV screen.

Partnership with Shopify opens up Roku shopping to small and medium businesses.