$FROG: Opportunity Amidst Market Overreaction?

In my previous write-up on JFrog FROG 0.00%↑ , I argued that the company was not an ideal standalone candidate. My concern centered around the idea that their flagship product, Artifactory, could become commoditized as CIOs increasingly favor broader DevOps platforms over point solutions. To succeed, I believed JFrog needed to expand its offerings into security and shift its go-to-market strategy from inbound sales to a more proactive outbound approach.

This week, JFrog reported its Q2 earnings, which were in line with expectations but led to a significant downward revision of its full-year guidance. The market reacted harshly, with the stock plummeting nearly 30% in a single day. In this post, I’ll dive into the earnings report and explain why I decided to start a position in FROG despite the challenges.

Earnings Recap

JFrog reported revenue of $103 million, hitting the low end of its guidance and slightly missing Wall Street estimates. The company followed this with a reduction in its full-year guidance by $4.5 million, citing tougher macroeconomic conditions leading to increased deal scrutiny and reduced usage among its SMB customers. Approximately 20% of JFrog’s cloud business operates on monthly billing plans, which are prone to significant variability. This variability was particularly evident toward the end of the quarter, and the company is now working to transition these customers to annual contracts, aiming to make their cloud revenue more predictable.

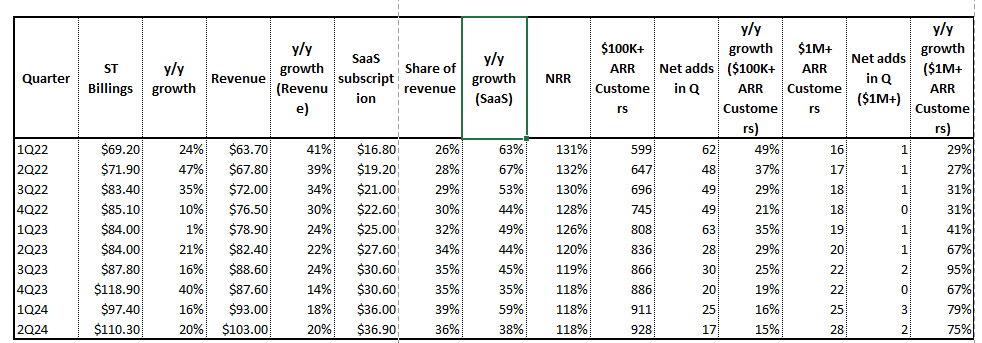

Customer metrics were solid, albeit with some deceleration. JFrog reported 42 customers generating $1 million or more in ARR, up 75% year-over-year and 5% quarter-over-quarter. Customers with ARR of $100K+ reached 928, growing 14% YoY and 2% QoQ.

Notably, about 50% of revenue now comes from customers using the full JFrog platform. While this was flat compared to the prior quarter, it represents a 5 percentage point increase from last year. This is a critical KPI to monitor because JFrog's success as a standalone company hinges on customers adopting its entire platform, including its security offerings. On that note, JFrog mentioned that its security product won't be a significant contributor to revenue until 2025, which is concerning since security adoption was a key part of the long thesis.

Net Dollar Retention Rate (NDRR) came in at 118%, in line with expectations and strong compared to peers, though management expects this to decelerate in the second half of the year, ending in the mid-teens. Gross dollar retention rates remained stable, indicating that the revenue guidance cut wasn't due to competitive pressures or higher churn. While RPO and billings numbers were solid, they are backward-looking metrics. Given that issues emerged toward the end of Q2 and into early Q3, any deterioration in these metrics is likely to surface in future periods.

The Market’s Reaction

What made the earnings miss and the guidance cut more perplexing—and partly why shares dropped 30%—was the fact that JFrog had reiterated its guidance just days before the close of the quarter. It's important to note that JFrog’s revenue base is still relatively small (~$400 million annualized based on Q2), so even slight changes in consumption patterns or deal timing can have an outsized impact. This dynamic will work in reverse as well; when the macro environment stabilizes, deals that were delayed could close, potentially leading to a significant rebound.

Why I Bought the Dip

Despite the challenges JFrog faces and my ongoing skepticism about its future as a standalone company, I decided to take advantage of the 30% drop and initiate a position in FROG 0.00%↑. Management’s decision to lower guidance, primarily due to a slowdown in cloud migrations, seems prudent. By excluding deals still awaiting budget approvals, they’ve set a more conservative, and thus more attainable, benchmark. This approach not only de-risks future performance but also suggests that the market may have overreacted to these short-term challenges.

Moreover, JFrog's dominant position in artifact management, particularly with Artifactory, makes it an attractive acquisition target. This potential for M&A activity provides a layer of downside protection at current price levels. Another potential upside comes from JFrog’s partnership with GitHub, which allows joint customers to leverage GitHub’s strengths in source code management alongside JFrog’s expertise in binary management. This collaboration could drive revenue growth in the second half of 2024 and into 2025.

At a $2.3 billion enterprise value, FROG 0.00%↑ is now trading at 5.5x estimated 2024 sales and 3.9x estimated 2026 sales, well below historical acquisition multiples in the software space, offering further downside protection. I believe management has done a reasonable job of de-risking their guidance, and unless macro conditions worsen significantly, the likelihood of further guidance reductions is low.

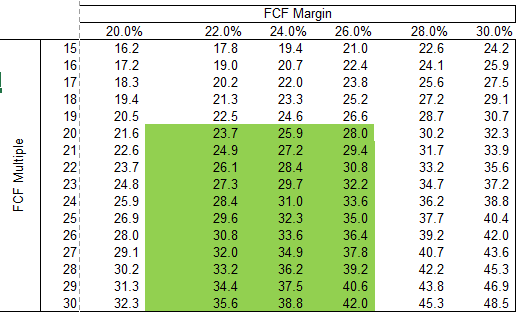

To frame potential outcomes, I’ve used a relatively conservative assumption of mid-teens CAGR in topline growth, projecting revenue to reach approximately $730 million with free cash flow margins expanding to 24% by 2028. Applying a 25x FCF multiple, a 10% discount rate, and 2% annual dilution yields a share price target of ~$30. Given the downside protection from potential M&A and the modest assumptions needed to achieve double-digit annualized returns over the next five years, I’ve decided to take a chance on FROG.

Disclosure: I purchased shares FROG 0.00%↑ at $23.76. I reserve the right to buy or sell shares at any time without prior notice.