Darling Ingredients: A Deep Dive Into Its Business, Market Position, and Future Prospects

Darling Ingredients DAR 0.00%↑ produces natural ingredients derived from animal byproducts and other organic residuals. It operates in three segments: Feed Ingredients, Food Ingredients, and Fuel Ingredients.

Feed Ingredients

The Feed Ingredients segment is DAR’s largest, accounting for 60–65% of revenue. Essentially, the company takes waste from meat production, fat, bone, offal, and renders it into usable materials like animal fats, protein meals, and minerals. This process is fundamental to the rendering industry, preventing millions of pounds of animal byproducts from ending up in landfills while recycling them into feed and industrial ingredients. DAR is the world’s largest renderer, holding about 15% of the market and processing over 12M metric tons of residuals annually. Scale is a key advantage, giving the company a broad sourcing network across slaughterhouses, butchers, and restaurants, reinforcing its position in an otherwise fragmented industry. Because DAR is vertically integrated, it has the flexibility to direct fats into either animal nutrition or energy markets depending on pricing dynamics, allowing it to capture value across cycles.

The key drivers of this segment’s performance are raw material volume processed, finished product yields, and commodity price spreads. DAR secures raw materials through indexed pricing formulas that aim to stabilize gross margins per ton. However, rapid swings in commodity prices can still compress margins in the short term since there’s a lag between procuring raw materials and selling finished goods. If fat prices drop suddenly after DAR has locked in raw grease at higher costs, margins contract until procurement costs reset. In recent years, the company has expanded this segment significantly through acquisitions. In 2022, DAR acquired Valley Proteins for $1.1B, adding 18 rendering plants across the U.S. Southeast and Mid-Atlantic, and also bought Brazil’s largest independent renderer, FASA Group, which operates 14 plants processing 1.3M metric tons annually. These acquisitions strengthened DAR’s raw material access and further secured feedstock supply for both feed and fuel applications. Commodity volatility has played a major role in segment performance. In recent years, global fat prices surged due to biofuel demand and tight supply, pushing EBITDA and margins to record highs. However, by late 2023 and into 2024, fat prices declined sharply, creating a margin headwind despite DAR shifting fats into the highest-margin use cases. While raw material cost adjustments, such as paying slaughterhouses less for byproducts when output prices fall, eventually help realign margins, this takes time. When commodity prices swing sharply, margins inevitably feel the impact due to the timing lag of COGS adjustments.

Competition in the rendering industry is largely regional, with major meat processors like Tyson, JBS, and Smithfield rendering their own slaughter byproducts internally. Independents like DAR, however, collect from smaller plants, grocers, and restaurants. Industry consolidation has allowed DAR to cement its dominant position as the largest independent renderer in North America. Another key advantage is its vertical integration with its Renewable Energy segment through the Diamond Green Diesel JV. Unlike competitors, which lack a dedicated biofuel outlet for waste fats, DAR can pay more for raw materials because it captures additional value downstream in fuel markets. In effect, its only real global competitor in scale and reach is the rendering arm of multinational meatpackers, but since those are captive, DAR occupies a unique competitive position in the industry.

Looking ahead, protein production growth in emerging markets will continue feeding more raw materials into DAR’s network, and the company is actively expanding its geographic footprint with new plant developments. Sustainability trends also favor the rendering industry, with increasing regulatory pressure to ensure proper recycling of animal byproducts. Commodity cycles will remain a key factor, low prices in 2024 weighed on results, but management anticipates an improved environment in 2025 as global fat supply and demand rebalances. Revenue was impacted almost entirely by lower end-product prices, and as prices have stabilized, the business should return to growth in 2025.

Food Segment

In the Food segment, Darling produces ingredients for human consumption and health, notably gelatin, collagen peptides, and edible animal fats. These products originate from the same animal supply chain but require higher quality and safety standards than feed-grade materials. Gelatin is derived from collagen in animal hides, bones, and pigskins and is widely used in food, gummies, desserts, pharmaceuticals, capsules, tablets, and nutraceuticals. Collagen peptides, hydrolyzed collagen, are a fast-growing category in health & beauty, used in supplements for skin, joint, and metabolic health, a trend Darling is actively leveraging with new peptide innovations. Additionally, Darling makes edible fats like lard and edible tallow, which are used in cooking, baking, and processed foods, or even biodiesel feedstock if food-grade demand is weak. This segment essentially takes certain rendering outputs and upgrades them to food grade through further processing in specialized facilities, refining fats, or extracting and purifying collagen. Darling’s Food segment operates globally under brands like Rousselot, the world’s leading gelatin & collagen producer, and CTH, natural sausage casings. The company processes about 1.23M metric tons of raw material for Food Ingredients per year. Gelatin production involves a multi-week process of cleaning, acid/alkali treatment, and extraction of collagen, then drying into gelatin powder. The longer processing cycle means gelatin pricing changes take longer to flow through margins compared to feed products.

This segment represents 20–25% of revenue and was transformed with a major acquisition. In 2023, Darling acquired Gelnex, a Brazilian gelatin and collagen producer, for roughly $1.2B. Gelnex added six gelatin facilities and an estimated $85M EBITDA contribution in 2024. Along with Rousselot’s existing plants in Europe, North America, China, and South America, this made Darling the undisputed global leader in gelatin. The integration of Gelnex, completed in Q2’23, boosted raw material volumes and allowed Darling to serve growing demand in markets like Brazil and Asia with local production. Meanwhile, the company also optimized its operations by closing a collagen plant in Peabody, MA, in 2023 to consolidate volume into more efficient sites. Profitability is solid and historically this segment has the highest EBITDA margin of Darling’s three segments because of the value-add nature. The segment’s cash flows are more stable than Feed or Fuel since food ingredients demand is less cyclical than commodity feed or fuel. Gelatin contracts can be annual and somewhat insulated from daily price swings. One financial synergy of this segment is that it upcycles materials, bones, skins, that might otherwise be sold at lower value in Feed, boosting overall corporate margins. For instance, instead of rendering all pigskins into low-value protein, Darling can channel some to high-purity collagen production. Revenue in this segment was impacted primarily by pricing normalization after the peak in early 2023, but with demand remaining strong and cost structures improving, management expects a return to steady growth in 2025.

Globally, the gelatin and collagen market is an oligopoly-like structure with a few key players. Darling, Rousselot + Gelnex, and Gelita AG, a private German firm, are the top two producers worldwide, each holding substantial market share. Other competitors include PB Leiner, part of Tessenderlo Group in Belgium, Nitta Gelatin in Japan, and smaller regional players. Post-Gelnex, Darling likely has the #1 market share in gelatin and collagen. This scale brings advantages in serving multinational food and pharma clients and in securing raw materials, as Darling’s integration with rendering gives it captive access to bones and skins. Natural casings competition is separate, with main competitors being specialty casing firms, such as Peter Gelhard Naturdärme in Europe. Pricing power in gelatin is moderate, historically, the big players have avoided price wars and managed capacity expansion rationally. A potential disruptor is the rise of plant-based or bio-engineered gelatin alternatives, with startups exploring collagen made via fermentation to create vegan gelatin. While these are not yet cost-competitive or produced at scale, they bear watching as a long-term threat to animal-based gelatin. For now, the established producers benefit from decades of know-how and quality records, which is critical for pharma-grade gelatin. In collagen peptides, competition includes not just other gelatin makers but also branded ingredient companies focusing on nutraceuticals. Darling has tried to differentiate via R&D in specialized peptide formulas. Overall, the competitive position of Darling’s Food segment is strong due to its vertical integration, own raw material supply, and global footprint, allowing it to produce in low-cost regions like South America and sell into high-demand markets worldwide.

Global gelatin demand is expected to grow steadily, ~5–7% CAGR, driven by food industry growth and emerging uses. Collagen supplements remain a high-growth niche as consumer awareness of collagen’s benefits rises. Darling is well-positioned to capture this with new capacity and product development. The CEO highlighted excitement for introducing new collagen products in 2025. Geographically, emerging markets, China, Southeast Asia, are consuming more gelatin in functional foods and beauty products, which favors producers like Darling who have local presence, such as a gelatin plant in China and now more in Latin America via Gelnex. On the risk side, input supply could be volatile. If global beef production declines, less hide for gelatin, or if another swine fever outbreak hits, pigskin supply drops. Also, currency fluctuations can impact this segment because production and sales are global. For example, a strong dollar can make exports from Europe less competitive, though Darling can hedge by producing in multiple regions. Pricing passed a peak in early 2023 and some normalization occurred. The segment’s performance in 2025 may not repeat 2022’s highs unless there’s a supply crunch. Nonetheless, Darling expects continued strong performance in its specialty food ingredients line and sees hydrolyzed collagen as a key long-term growth driver, indicating confidence in sustained demand.

In summary, the food segment is a stable, growing segment where Darling’s strategy is to move further up the value chain, more collagen and specialty products, to enhance margins and resilience. Another KPI to watch for this segment is pet ownership rates and spending per pet. Pet ownership trends remain robust, though the pandemic surge is leveling off. Owners continue to humanize pet diets, seeking high meat content and natural ingredients, a plus for animal-derived inputs. Financially, the segment should continue to provide a stable revenue base. Growth might not be explosive, but steady, with pet food outpacing livestock feed. Innovation like insect meal or nutrient recovery from food waste could become more significant contributors over a five-year horizon, aligning with sustainability goals and possibly commanding premium prices.

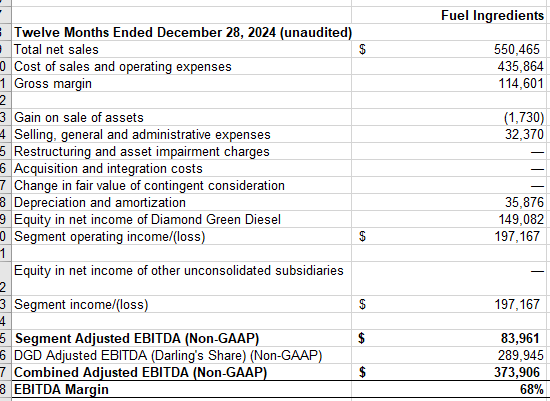

Fuel Segment

Darling’s Renewable Energy segment centers on converting fats and oils into biofuels, primarily through its DGD joint venture with Valero Energy. Renewable diesel (RD) is a drop-in fuel, chemically identical to petroleum diesel, but made from renewable feedstocks like used cooking oil, animal fat, and inedible corn oil. Unlike biodiesel, RD can fully substitute diesel in engines and pipelines. Demand for renewable diesel and related biofuels, like sustainable aviation fuel (SAF), is surging due to global low-carbon fuel standards, renewable fuel mandates, and tax incentives. Key U.S. policies include the Renewable Fuel Standard, which awards tradable credits (RINs) for each gallon produced, the $1/gal Blender’s Tax Credit, and California’s Low Carbon Fuel Standard, which provides extra credits for waste-derived fuels. These programs have made RD production economically attractive, spurring a boom in capacity. As a result, Darling and Valero, early movers with DGD since 2013, are now among the world’s largest renewable diesel producers, second only to Finland’s Neste.

GD is a 50/50 joint venture, leveraging Darling’s feedstock collection and Valero’s refining expertise. The partnership began producing RD in 2013 with a 160M gallon per year plant in Norco, LA. Major expansions followed, with the Norco facility increasing to 690M gallons per year in 2021 and a new 470M gallon per year DGD plant coming online in Port Arthur, TX, by late 2022. As of 2023, DGD’s total capacity is approximately 1.2B gallons per year, making it a world-scale producer. This integrated operation is a cornerstone of Darling’s growth, transforming low-value waste fats into high-value fuel. Darling supplies a significant portion of DGD’s feedstock, including rendered animal fat, used cooking oil, and trap grease, and in return, receives 50% of the profits. The joint venture structure means Darling’s revenue does not include DGD’s sales directly; instead, the company records its share of DGD net income in equity income and receives cash dividends. In Q3 2024, Darling received $111.2M in cash dividends from DGD, underscoring how critical this business is to overall cash generation. Revenue in this segment was impacted primarily by lower diesel prices and weaker credit values in 2024, but as margins improve, the business should return to growth in 2025.

DGD processes exclusively waste oils, such as animal fats, used cooking oil, and distillers' corn oil, which have a lower carbon intensity than virgin vegetable oils. This results in a higher number of LCFS credits per gallon and aligns with regulatory incentives favoring waste-based feedstocks. This vertical integration is a key competitive advantage, particularly as renewable fuel capacity expands and waste feedstocks become more valuable. Darling has the ability to channel its raw materials into DGD rather than selling them on the open market, providing significant strategic flexibility. DGD’s profitability depends on the spread between diesel prices, plus credits, and feedstock costs. In 2023, DGD realized approximately $0.81 in EBITDA per gallon, exceeding the original investment case of around $0.79. However, in 2024, margins tightened due to lower diesel prices, declining RIN and LCFS credit values, and rising feedstock costs. By Q3 2024, EBITDA per gallon had fallen to about $0.25, reflecting these headwinds. This volatility highlights how policy and commodity cycles significantly influence the Renewable Energy segment.

Government policies are central to this segment’s economics. Programs like the RFS in the U.S. and Europe’s RED II drive demand by requiring renewable fuel use. The Blender’s Tax Credit, which was extended through 2024 under the IRA, has provided stability, and from 2025 onward, the IRA will introduce the Clean Fuel Production Credit, which should continue to support RD, particularly SAF, which qualifies for additional credits. State level programs like California’s LCFS, Oregon’s Clean Fuels Program, and Canada’s Clean Fuel Standard further support RD pricing. While these policies create a strong price floor for renewable diesel, regulatory risk remains a concern. Any weakening of mandates or credits could pressure margins, though global momentum is largely in favor of expanding low-carbon fuel policies. Valero’s CEO noted recently that "we expect low-carbon fuel policies to continue to expand globally and drive demand for renewable fuel," and Darling has echoed this sentiment, stating that the evolving regulatory landscape is increasingly supportive of waste-derived fuels, reinforcing its long-term growth potential. A major catalyst ahead is the expansion of sustainable aviation fuel, with DGD investing in SAF production at its Port Arthur facility, which is expected to be completed in early 2025. The IRA offers up to $1.75 per gallon in SAF credits, which could significantly boost margins if offtake agreements with airlines are secured.

Renewable diesel has become more competitive in 2024, attracting several refiners and energy companies. Neste, based in Finland, remains the largest global producer, with facilities in Singapore and Rotterdam. In North America, new entrants such as Marathon’s joint venture with Neste in Martinez, CA, Phillips 66’s Rodeo conversion in CA, Chevron’s expansion of Geismar, LA, after acquiring Renewable Energy Group, and BP’s push into biofuels have all intensified competition. Despite this, DGD’s first-mover scale and access to feedstock provide strong cost advantages. Many competitors must buy feedstock from the market, often from Darling itself or its peers, whereas Darling and DGD internalize that margin. This vertical model is difficult to replicate quickly, and DGD’s integration with Valero’s refineries further enhances efficiency. However, competition for feedstock is increasing, with new RD plants bidding up prices for used cooking oil, tallow, and waste fats. Darling’s 2022 acquisitions of Valley Proteins and FASA were strategic moves to lock in more feedstock in response to this trend. While the renewable diesel market itself is getting more crowded, Darling’s true competitive advantage lies in feedstock sourcing, where it remains the dominant player. As long as waste fats remain scarce and highly valued for low-carbon fuel, Darling retains a defensible position in supplying the growing RD and SAF industry.

The Renewable Energy segment, which is reported as Fuel Ingredients plus equity income from DGD, has become a major earnings and free cash flow driver for Darling. In 2024, DGD paid Darling approximately $180M in cash dividends, demonstrating its ability to generate cash even in weaker margin years. The venture’s balance sheet is strong enough that DGD is entirely self-funding its own SAF expansion. In essence, Renewable Energy is a somewhat cyclical but highly profitable segment. In strong years, it significantly boosts Darling’s earnings, while in weaker years, it still provides valuable cash flow and serves as a reliable outlet for low-value feedstocks.

The long-term outlook for this segment is closely tied to the broader energy transition. With tightening climate targets and increased demand for bio-based diesel and jet fuel, the market is expected to grow rapidly. Darling projects a favorable 2025 environment as new SAF capacity comes online and waste-based feedstocks gain further policy support. DGD’s Port Arthur SAF project, which will allow 50% of its output to be SAF, should capitalize on higher credits ($1.75/gal for SAF) and increased airline adoption. Further global expansion could be on the horizon, as DGD has so far been focused primarily on North America. Given Darling’s existing footprint in Europe, where Neste is currently the dominant producer, an eventual move into the European biofuels market could be a logical next step. The biggest risk remains regulatory uncertainty, and keeping a close eye on potential policy changes will be critical in shaping expectations for this segment’s long-term trajectory.

Valuation

Looking at it from an EV/EBITDA perspective, DAR has traded around a 7x–10x EBITDA multiple in the past. Using 2023’s peak EBITDA of $1.61B and an assumed ~8x multiple, one would get an EV of ~$12.9B. After accounting for debt of $4B, equity value would be ~$8.9B, or about $59 per share. On depressed 2024 EBITDA of ~$1.16B and applying a depressed 7x EV/EBITDA multiple, EV would be ~$8.1B, and after debt, equity value would be ~$4.1B, or $27 per share. I think 7x EBITDA seems too low of a multiple given its diversified earnings streams and strong market positions. Commodity agricultural processors like Bunge or Archer Daniels often trade 6–8x EBITDA, while specialty chemical or ingredient firms trade 10–12x EBITDA. Renewable fuel peers like Neste trade higher, historically ~12–15x EBITDA. Given Darling’s unique position, a sum-of-the-parts approach could argue for a higher multiple. The fuel segment could be valued akin to renewable energy companies (~10x EBITDA for that portion), the food segment like a specialty ingredients business (~10x), and the feed segment at a lower multiple (~7–8x) due to commodity exposure. Weighted, that comes out around 8–9x, which seems like a fair range.

They guided for $1.25–$1.3B in EBITDA for 2025, which I think is somewhat of a sandbagged guide, but applying a 7x multiple to the lower end of the range yields an EV of just under $8.7B. Debt should come down by about ~$400M (they said $350–500M on the call), leaving it at $3.6B by the end of the year. So $8.7B EV minus $3.6B of debt would leave the market cap at around $5.1B, or $34 per share, slightly below the $36/share the stock is trading at today. If we assume they hit the higher end of the range of $1.3B EBITDA and an 8x multiple, the price would be $45 per share.

Valuation is not a science but more of an art in order to get guardrails around what a reasonable estimate might be for the business. From my perspective, I would be a buyer of the stock in the low $30s and a seller in the low to mid $50s range.

Very Bullish Scenario ($88/share)

If strong tailwinds occur across all segments, global fat prices recover sharply, improving Feed margins, DGD runs at full capacity with $1+ EBITDA/gal thanks to high diesel spreads and lucrative SAF credits, and the Food segment benefits from high gelatin/collagen demand with price increases. In this scenario, combined EBITDA could reach $1.8B+ in a couple of years. At even a 9x multiple (acknowledging the growth), EV would be $16.2B. Subtracting debt (which will prob be around $3B), equity value would be $13.2B, or roughly $88 per share. This bull case also assumes Darling might de-lever and perhaps buy back shares, further boosting equity value.

Bear Scenario ($27/share)

If headwinds persist, a global recession cuts meat production (lower volumes) and pet food spending, regulators scale back biofuel incentives, and competitors eat into some market share, combined EBITDA might stagnate around $1.1–1.2B. If we apply a cautious 7x multiple (as growth prospects would look dim), EV would be ~$7.7B, with debt at ~$3.6B, leaving equity at ~$3.7B, or about $27 per share. This case is relatively assumes prolonged low margins and no growth, but it underscores the downside risk if multiple adverse factors coincide and are persistent.

Base Scenario ($60/share)

The more likely path is between these extremes. Suppose 2025 EBITDA is $1.3B, growing to $1.5B by 2027, with DGD’s SAF expansion and incremental improvements. Using ~8x multiple for a forward outlook, EV would be ~$12B, minus $3B in debt (assuming some paydown), leaving equity at ~$9B. With share count stable, that’s about $60/share. This aligns with many analysts’ views that Darling’s fair value is in the mid-to-upper $50s under normalized conditions.

In summary, if the stock trades in the low $30s, it presents a buying opportunity, and at the low-to-mid $50s, it starts looking more fairly valued with upside to the $60s in a base case scenario. The bull case, if fundamentals align, supports a valuation closer to $90, while the downside risk in a weak environment is around mid $20s.