APP Delivers a Blow Out Quarter (Again)

Business Overview:

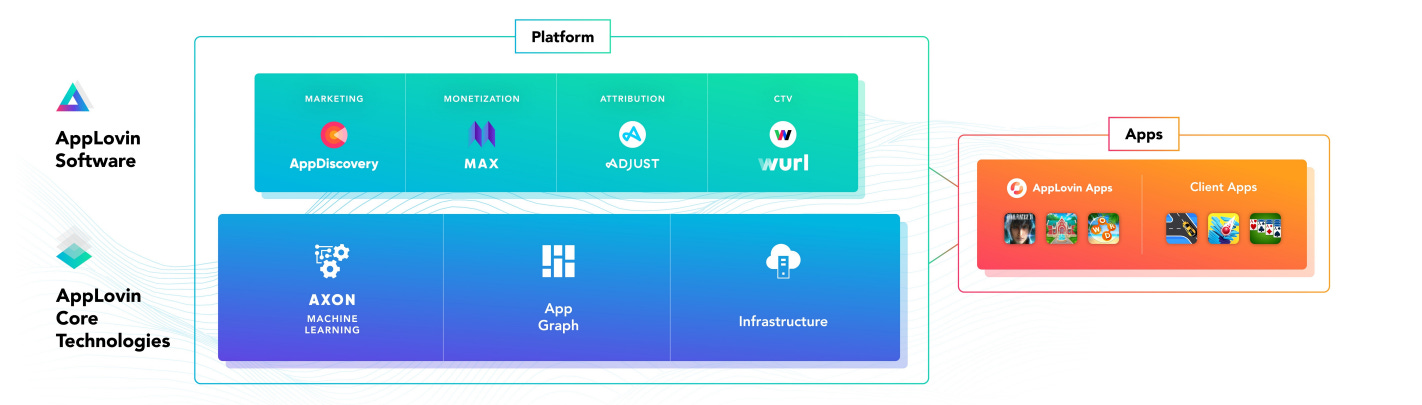

APP sells software tools to app developers to help them market and monetize their apps. It also owns its own mobile apps. The high margin software business drove recent growth, but its durability remains uncertain given the competitive environment they operate in. It has two main business segments:

Software Business:

This is APP's core SaaS business. It provides app developers tools to market their apps and acquire new users through ads.

APP has a recommendation algorithm called AXON that optimizes which ads to show users to get them to download new apps. This helps developers get the most downloads for their ad spending.

AppDiscovery: Helps match apps with users.

Adjust: Helps marketers measure how well their advertising is working and keep user data safe.

MAX: Helps make more money from in-app ads.

Wurl: Helps distribute streaming video for content companies.

It also provides app measurement tools to track things like user engagement and purchases in-app. These help developers improve their apps.

APP charges developers a percentage fee on the ad spend through its platform. So its revenue grows as ad spend grows.

Apps Business:

This is APP's own portfolio of mobile games and apps it has developed or acquired like Word Connect and Lion Studios. They have over 350 mobile games made by eleven studios and use their own Software Platform to promote and monetize these games. However, they are re-evaluating their portfolio and have sold or closed some studios to optimize their profits.

APP monetizes these apps by showing ads to users using its own software tools above. The apps business is less profitable than the software business.

Owning apps provides data to improve APP's software algorithms. But the apps business is seen as more volatile and less attractive.

They have bought or partnered with 29 other companies since 2018, spending nearly $4.0 billion. This includes software companies and game studios.

AXON Ad Tech Platform:

AXON is the core software platform that powers APP's advertising business. It is the technology that runs their ad network.

In simple terms, AXON is the brain that matches advertisers looking to promote their apps with publishers who have ad space to fill within their apps.

When you see ads within mobile apps, AXON is the technology behind the scenes facilitating that. It conducts a real-time auction between advertisers bidding to show their ads, and automatically selects and displays the winning ad within the publisher's app.

AXON uses advanced machine learning algorithms to optimize and automate this process. It predicts which ads will perform best for each user based on data like user demographics, behavior, and preferences. This benefits both Advertisers and Publishers

Advertisers get to show their ads to only interested and relevant potential customers. This improves efficiency and return on their ad spend.

Publishers earn more revenue by showing higher quality targeted ads that are more valuable to advertisers.

AXON 2.0 is AppLovin's latest upgrade to the platform, launched in 2Q’22. It incorporates the latest AI advancements to make the matching and bidding process even faster, smarter and more optimized.

By improving the algorithms and automation, AXON 2.0 helps AppLovin grow their advertising business and market share. Early results contributed to their strong Q2 financial performance.

2Q Earnings:

Revenue of $750M, exceeding high end of guidance range, driven by software platform growth.

Software platform revenue reached record $406M, up 28% year-over-year.

Adjusted EBITDA of $334M, 44% margin, exceeding high end of guidance. Driven by software platform growth and operating leverage.

Net income of $80M.

Free cash flow of $221M.

Software platform adjusted EBITDA margin increased to 67%, with high flow-through from revenue to EBITDA. Expect further margin expansion.

Apps revenue $334M. Focusing on profitability and growth. Targeting mid-teens EBITDA margins.

Launched AXON 2.0 ad tech platform upgrade in Q2. Seeing benefits with advertisers and contribution to growth.

Q3 guidance: Revenue of $780M-$800M, adjusted EBITDA of $340M-$360M, 44-45% margins.

Generated $221M FCF, 66% conversion of adjusted EBITDA.

$0.5B+ FCF in first half of 2023.

Targeting 50-60% of adjusted EBITDA conversion to FCF

Continued buybacks with $507M in Q2. $601M year-to-date.

Remain confident in future growth driven by AXON platform, apps portfolio, and execution against focused strategy.

Software Platform:

Revenue reached record $406M, up 28% year-over-year. Driven by AXON platform upgrade.

Adjusted EBITDA grew 39% to $273M, 67% margin. High flow-through from revenue to EBITDA.

Revenue up 2.8x over past 2 years, 67% CAGR. Adjusted EBITDA up 3x, 70% CAGR.

Continued optimism on growth opportunities as they enhance AXON and invest in initiatives like CTV.

Apps Portfolio:

Apps revenue $334M in Q2. Focus on balancing growth and profitability.

Investing in game development and user acquisition while managing margins.

Using AXON solutions to drive more efficacious spending.

Targeting mid-teen EBITDA margins for apps business.

AXON 2.0:

Launched upgraded ad tech platform AXON 2.0 in Q2.

Seeing benefits in platform accuracy, advertiser ROI, and ability to monetize broader base.

Contributed to software platform revenue growth in Q2. Expect further benefits.

Applying learnings to continuously improve the AI technology.

Conclusion:

APP's recent financial performance has consistently outpaced analyst expectations, notably in terms of adjusted EBITDA. These impressive results from the second quarter have positioned APP as one of the best preforming stocks YTD. Furthermore, the company's forecast for 3Q adjusted EBITDA surpassed expectations by an impressive $50M, propelling the stock price to soar by approximately 25%, on top of an already remarkable 180% growth YTD.

This trajectory exemplifies the profound effect that fundamental shifts, especially in relation to market expectations, can have on stock price through multiple expansion. Entering the year, the prevailing market sentiment was bearish. Concerns such as the predicted economic downturn, expected reductions in consumer spending, diminished advertiser demand, intensified competition due to the IS & U merger, and evolving iOS and Android policies, which could potentially hamper the mobile advertising sector, were all prevalent. Amid these concerns, APP's enterprise value stood at roughly $6.2B, or 6x the 2023 adjusted EBITDA predictions. Furthermore, projections indicated stagnant growth for both topline and adjusted EBITDA in 2023.

However, a turning point emerged in February when APP unveiled better-than-anticipated results for 4Q'22 and forecasted an optimistic 1Q23. Despite the lack of sequential growth in software platform revenue and persistent concerns about a potential 2023 recession, signs began to emerge suggesting a more prosperous year than previously forecasted.

When APP disclosed its 1Q'23 results, it revealed a growth in software platform revenue that exceeded analyst expectations by 37 percentage points. This substantial growth translated into an adjusted EBITDA surplus of $15M. Such a performance prompted analysts to adopt a more bullish outlook, adjusting their projections for the software platform upwards and consequently improving EBITDA margin forecasts. The stock's value reflected this positive shift, with a 25% surge post the 1Q announcement. The consensus now estimates a 4% topline growth, predominantly driven by the software platform, with a noteworthy rise in EBITDA margins from the year's outset.

Market sentiment has notably evolved, with the prevailing view now being a softer economic trajectory without a looming recession. This broad market shift, coupled with APP's stellar software segment performance, has resulted in multiple expansion. Currently, APP's valuation stands at 12x the 2023 EBITDA, a significant leap from 5X at the year's commencement. Furthermore, 2023 EBITDA margin predictions have increased from 37.7% at the start of the year to 42.3% due to the accelerated revenue growth in software. The company's EV has surged by approximately 150% since January, reaching $16B, while 2023 EBITDA projections have climbed 20%. Notably, 70% of the increase in EV can be attributed to multiple expansion, with the remaining 30% resulting from revised EBITDA estimates.

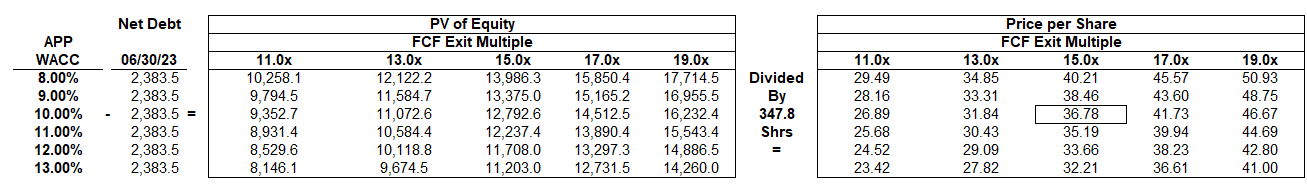

Considering APP's nearly four-fold return YTD, questions arise regarding its current valuation. I often rely on reverse DCF analysis to deduce what's incorporated into the stock price. For APP, my assumptions are a 2% topline CAGR through 2027, with adjusted EBITDA margins progressing from 40% in 2023 to 48% by 2027. Management anticipates that 50% of the adjusted EBITDA will translate to FCF, which pegs my 2027 FCF margin at 24%. My exit multiple assumption stands at 15x-16x EV/FCF for 2028, resulting in a PV of approximately $37/share at a 10% discount rate.

These assumptions appear reasonable, and if APP maintains its momentum, particularly in its software segment, there's potential for further stock appreciation. However, it's essential to note that the stock is no longer the steal it once was at less than $15/share, especially considering formidable competition from both industry giants like GOOG Ad Manager and IS/U, as well as emerging players like Fyber, PUBM, among others.