2024 Markets: Navigating the New Normal

As 2023 wraps up, it's worth taking stock of the year's economic landscape, even if the turn of the new year is just a symbolic milestone. Skepticism shadowed the start of 2023, with concerns about the economy's resilience in the face of soaring interest rates. Yet, the economy has defied expectations, not only steering clear of recession but also demonstrating robust GDP growth. Inflation, once a dominant worry, has now fully faded into the background. Core CPI data signals the lowest inflation rate since September 2021, hinting at a gradual easing of inflationary pressures.

The Federal Reserve's fund rates have seemingly reached their zenith, with Fed projections indicating three 25 basis point cuts in 2024. However, market predictions are more bullish, expecting five rate cuts and ending the year at 375-400 basis points. The markets seem to have fully embraced a 'Goldilocks' scenario – a perfect balance where inflation cools off and economic growth remains vigorous. Consumer spending remains strong, as evidenced by retail and credit card data. Unemployment claims are low, synonymous with economic expansion, and corporate balance sheets and earnings are solid. Despite the headwinds of higher rates, housing prices remain high due to dwindling inventory and a slowdown in transactions. The fiscal and monetary policies implemented during the COVID era have bolstered consumer balance sheets, leaving them in a strong position, while government balance sheets have become more leveraged.

The U.S. economy rode a wave of heightened demand in 2023, thanks to government fiscal initiatives and the release of pandemic-induced personal savings. This led to a robust economic climate. As 2024 approaches, a shift in these dynamics is on the horizon. We're likely to see a slowdown in consumer spending and overall economic activity, pointing towards a significant deceleration in growth. A key factor in this shift is the expected cooling in labor markets, where increased availability of workers will temper wage growth without triggering a rise in unemployment. Additionally, ongoing productivity gains are poised to further curb inflation. Currently, housing costs are the main driver of high inflation, but with drops in rental rates and potential drops in home prices, a sharper decline in core inflation is expected. So far, supply factors have primarily driven disinflation, however, with the full impact of monetary tightening yet to unfold, demand-driven disinflation will likely intensify, potentially driving inflation rates below Fed targets quicker than currently projected. While a slowdown is anticipated, a severe recession seems unlikely. The Fed has ample room for policy adjustment, and the solid state of household and corporate balance sheets provides a cushion against income shocks, mitigating the risk of a deflationary deleveraging cycle. This financial resilience could help stabilize the economy amidst slower growth. Looking ahead, if inflation continues to ease and a major recession is averted, we might see a deceleration in nominal earnings growth and a notable reduction in bond yields, offering support to equity markets via higher multiples. Historically, discount rates have had a more pronounced impact on equity values than changes in earnings forecasts. If this trend persists, equities are set to outperform cash and fixed-income investments in terms of total returns, despite the 2023 rally.

Looking towards 2024, the strength of consumer spending, now representing 70% of GDP, remains a crucial factor. Despite the Fed's progressive interest rate hikes, household spending has shown remarkable resilience throughout the year, a trend that's persisted into Q4 as evident by the surge in consumer credit card expenditure and the strong performance of retail stocks. In a surprising turn, November's core retail sales rose, defying expectations of a downturn. The broader PCE measure echoes this robustness, with spending on services notably surpassing that on goods – a reversal of the pandemic-era trend. Retail stocks have been star performers, soaring 26% since October and outstripping the S&P 500's growth.

Post-Covid, households have seen improved balance sheets, bolstered by substantial government subsidies, enabling debt reduction and savings growth alongside sustained spending. Despite higher consumer interest payments from the Fed's tightening, mortgage payments have only marginally increased, as many homeowners secured low rates earlier. The pandemic period witnessed a significant wealth effect from rising stock and house prices, leading to a substantial impact on consumer spending. However, these gains have likely reached their peak and we are returning to more normal run-rate levels. Employment dynamics have evolved, with labor shortages and increased worker leverage. Unemployment rates and claims remain historically low, and job openings, though reduced by about 30% from their peak, still exceed pre-pandemic levels, suggesting easier access to labor for lower-skilled positions.

Consumer behavior has reverted to services like hospitality and travel, with spending in these areas growing at a 7% annual rate while labor productivity continues to rise and wage growth outpacing inflation for the past eight months. Despite these positive factors future outlook remans uncertain in the face of restrictive Fed policies and reversed fiscal stimulus. With an estimated $200-300 billion in post-pandemic savings remaining and a sustained positive wealth effect, a prolonged or severe economic contraction seems unlikely in 2024 as the consumer sector, and by extension the overall economy, faces minimal risk of a severe recession.

While signs of a consumer pullback are emerging, with the household savings rate at a historic low and weak consumer credit growth. Tightening bank credit conditions and rising bank loan charge-off rates point towards stricter lending standards, especially if economic growth slows. Delinquency rates for credit cards and auto loans are above pre-pandemic levels, but the housing sector, which is the bulk of peoples wealth, is healthy as mortgage delinquencies are expected to stay low due to cautious lending practices post-GFC, as evidenced by high median FICO scores at origination.

The market is currently anticipating a deflationary boom with stronger-than-expected consumption, inflation trending towards long-term targets, and real bond yields not dropping significantly, setting the stage for excessive speculation in risk assets to continue into 2024. Despite the 2023 rally and higher multiples compared to the broader indexes, mega cap tech is poised to continue outperforming in this scenario.

The treasury market echoes the sentiment that the Fed has successfully combated inflation. The recent decline in short-term interest rates, spurred by inflation rates lower than anticipated, suggests inflation will align with the Feds long term target sooner than anticipated and the Fed will cut rates to avoid excessively restrictive policy. Despite positive economic indicators, long-term rates have significantly decreased from their mid-October peak of 5%, with the 10-year now at 3.8%. This indicates investors remain cautious, bracing for slower growth in the upcoming year as recent mixed economic data has fueled this concern. This pessimism might be overstated, given the continued robust consumer spending, strong job market, and substantially eased financial conditions. Looking at the yield curve, the market anticipates the return of term premium and an early disinversion next year, with the 2s10s spread turning positive. The majority of the movement in the 10-year yield has occurred, and without signs of a severe recession, it's unlikely to fall much further, possibly bottoming around 3.5%. The short end of the curve is expected to decline significantly as the Fed normalizes rates from their current restrictive stance. The front end should continue to reflect expected disinflationary cuts and the possibility of the Fed easing rates below the neutral level while long-term rates are likely to have an upward bias due to structural factors and increasing supply-demand imbalances.

Equity Markets

The equity markets in 2023 witnessed a remarkable turnaround, with mega-cap stocks taking the lead in driving substantial gains. The NDX, heavily weighted towards mega-cap tech companies, soared by an impressive 55% over the year and hitting new ATHs. Interestingly, small-cap stocks, which typically are more sensitive to domestic economic changes, lagged behind for the majority of the year. However, in a significant shift in late October, these stocks caught a wave of investor interest post the perceived dovish shift in Fed sentiment. This late surge pushed the small-cap index into positive territory, closing the year with a 14% gain. This late-year rally in small caps could be attributed to investors seeking value opportunities after a prolonged period of underperformance relative to their large-cap counterparts.

Several factors contributed to this bullish trend in equities. Firstly, the resilience of the economy played a critical role. Heading into 2023, there were widespread concerns about economic downturns and recessionary pressures. However, the economy and corporate earnings held up much better than most analysts had predicted. This resilience bolstered investor confidence and spurred investments in the equity markets. Another pivotal factor was the market's perception of the Fed's monetary policy effectiveness. The widespread belief that the Fed had successfully 'slayed the inflation dragon' created a favorable backdrop for equities. The reduction in inflationary pressures and the Fed's signaling of a potential pivot in its interest rate policy added to the positive sentiment.

A notable reflection of this bullish market sentiment was the valuation of the S&P. At the beginning of the year, the S&P was trading at just under 17x its NTM earnings. This valuation was in line with historical averages and reflected a cautious optimism about future earnings growth and the economy. However, as the year progressed, the earnings multiple expanded to 20x NTM earnings. This increase in the multiple was a clear indicator of a significant shift in investor sentiment as worries about inflation and economic slowdown dissipated. Investors are now pricing in higher expectations for future earnings growth, driven by improved economic conditions and a favorable monetary environment.

Extremally positive options flows, especially towards the end of the year, were another driver for the equity market rally. The growth in structured products that utilize options for hedging purposes and are designed to provide tailored risk-return profiles, have become increasingly popular among institutional and retail investors. By employing strategies like selling put options and buying call spreads, these structured products aim to hedge against market downturns while capitalizing on uptrends. These structured products, due to their hedging components, can absorb some market shocks by influencing investor behavior by providing a sense of security against market downturns and reduce panic selling, potentially leading to a more stable market and a lower VIX in the short term. There is a risk that in certain scenarios that a large number of these products can be triggered by a market event and exacerbate volatility, causing a cascading effect to the downside.

At the sector level, semiconductors, homebuilders, internet companies, and travel services lead the charge, while solar and healthcare lagged. Semiconductors stood out as the year's frontrunners, primarily fueled by the emergence of AI. Investors, casting aside concerns over the current trough in earnings, particularly in the memory space, were enticed by the promise of AI. The semiconductor industry, essential for AI technology's growth, saw increased investment as businesses and consumers alike anticipated more integrated AI applications in daily life. This optimism wasn't just based on future projections; it was supported by tangible advancements in AI at the enterprise level and its increasing adoption across various sectors. The sustainability of enterprise demand for AI-based servers remains a topic of debate as we look towards 2024. While there is some uncertainty surrounding the long-term trajectory of this demand, the upcoming year is still expected to witness robust capital expenditure growth in the semiconductor sector. This optimism is grounded in the ongoing expansion and upgrade of data centers, driven by the escalating need for more powerful and efficient AI computing capabilities. However, what will truly drive semiconductor stocks in the latter part of 2024 is the growing clarity regarding demand prospects for 2025. As enterprises continue to integrate AI into their operations, their long-term commitment to upgrading and maintaining AI-based server infrastructure will become more evident.

Homebuilders presented a narrative of resilience and adaptation. Entering 2023, the sector was undervalued, largely due to investor fears over the impact of rising interest rates on housing demand and prices. The expected downturn in housing prices, however, did not materialize as predicted. Despite a significant decline in home sales, prices remained stable. The stability can be attributed to a constrained housing inventory and a lack of forced selling, which helped maintain price levels. Homebuilders adapted by seizing market share from existing home sales through flexibility. They offered various incentives, such as rate buydowns, to attract new home buyers, demonstrating flexibility and resourcefulness in a challenging economic climate. Travel services capitalized on a notable shift in consumer spending. As 2023 progressed, there was a discernible trend towards experiential spending. Consumers, possibly influenced by the long-term effects of the pandemic, showed a greater inclination to spend on travel and experiences rather than on tangible goods. This shift benefitted the travel services sector, which saw a resurgence in demand. The trend suggests a deeper change in consumer priorities and values, possibly indicating a long-term shift in spending habits.

The solar sector, in contrast, faced a tumultuous year. Initially, solar stocks suffered due to higher financing costs, which reduced the attractiveness of solar investments and dampened end demand. However, as interest rates began to lower, these stocks experienced a rebound. This sudden surge, particularly noticeable in stocks like ENPH, appears disproportionate to the underlying business fundamentals. ENPH's stock price, which soared by 30% in a month, reaching over $130, seems inflated considering the business's prospects aren't expected to improve significantly in 2024. This mismatch between market valuation and business fundamentals suggests an overreaction by the market, possibly making ENPH and attractive short. The healthcare sector, typically considered a safe haven, underperformed relative to the broader market in 2023. This underperformance may be attributed to several factors, including regulatory challenges, pricing pressures, and a slow pace of innovation in certain sub-sectors. Despite a late-year uptick, the sector's overall performance lagged and is a ripe area for attractive companies heading into 2024.

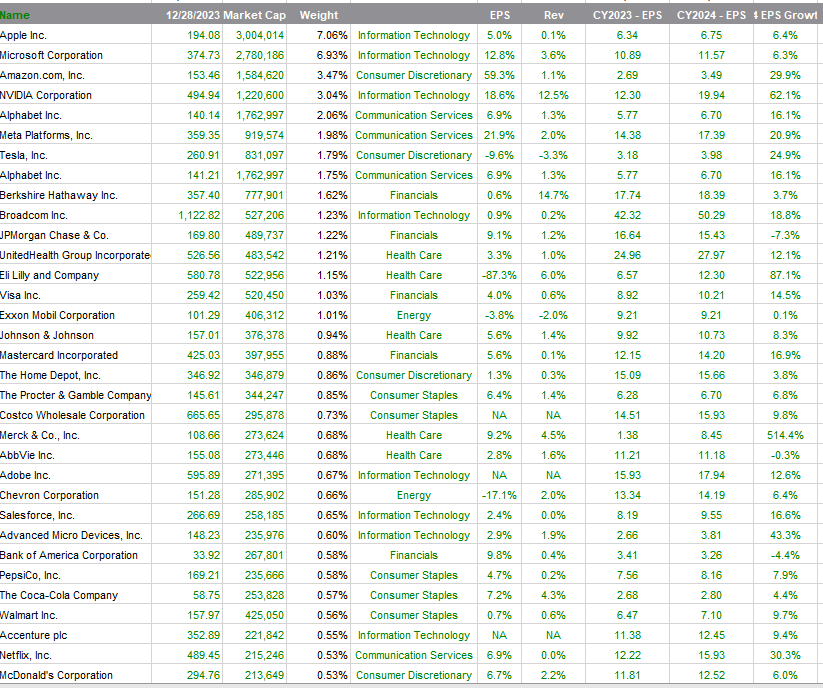

Throughout 2023, the prevailing narrative centered on how mega-cap stocks, constituting the top tier of the index, were the primary drivers of market returns. This observation holds true when looking at the index as a whole given that the top 7 stocks represent 28% of the index, however, there were plenty of companies outside the mega 7 that preformed well and over a thousand stocks with market caps over $300 million were up 30% or more for the year and almost 200 have seen their stock prices double over the year. This significant growth, often overlooked in broader market analyses, highlights the presence of substantial opportunities beyond the mega-cap domain. Among these high performers, certain stocks stand out for their exceptional gains. For instance, META 0.00%↑ saw its stock soar by almost 200%, and NVDA 0.00%↑, with a staggering 240% increase, still appear attractively priced when considering their forward-looking financial metrics. Their growth seems to be underpinned by solid fundamentals rather than mere speculative fervor, suggesting that these stocks might still offer value to discerning investors.

Conversely, other companies in this cohort such as COIN 0.00%↑ and SHOP 0.00%↑ , which have also experienced rapid share price appreciation, now find themselves at potentially precarious valuations. The recent run-up in their stock prices has pushed their market valuations to levels that may be challenging to justify based on their current and projected financial performance. While some stocks in this group may continue to offer growth potential, others might be subject to price corrections if their fundamentals do not support their heightened valuations.

The equity market in 2023 was shaped by a blend of economic resilience, effective monetary policy, and a significant shift in investor sentiment. This combination of factors created a favorable environment where mega-cap stocks flourished, and small-cap stocks, despite a late start, demonstrated a strong recovery. This performance mirrored the market's overall optimism regarding future corporate earnings and the stability of the broader economy. As we look ahead to 2024, it's shaping up to be a year of normalization which presents a dual-edged sword for the markets. On one hand, it signals a move away from the extremes – be it in terms of policy interventions, market volatility, or pandemic-induced economic anomalies. This shift could stabilize market conditions, reduce uncertainty, and offer clearer visibility into corporate performance and economic indicators. On the other hand, normalization also means the withdrawal of the extraordinary support measures that have buoyed markets and economies during turbulent times. This withdrawal could expose underlying vulnerabilities and lead to a reevaluation of asset valuations. This return to normalcy is expected to provide a fertile ground for investors to construct long/short portfolios that can capitalize on emerging opportunities and hedge against potential risks.

The landscape for equity markets appears more challenging compared to the previous year. The expectation for earnings growth is set at 11.5%, which would bring the aggregate earnings to around $245, positioning the market multiple at just under 20 times. This earnings growth, while robust, is accompanied by a more modest revenue growth projection of 5.5%. This disparity suggests that further margin expansion is anticipated, with margins potentially reaching around 13%. However, this expectation of margin expansion carries its own set of risks. In an environment where disinflationary pressures are at play, the impact on profit margins could be significant. Disinflation can affect pricing power and cost structures within companies, potentially leading to narrower margins. This scenario would challenge the assumption of margin expansion and can lead to earnings growth revision lower coupled with stretched multiples which could lead to adjustments in market valuations. The potential impact of disinflation on profit margins will be a key factor to watch, as it could influence both individual stock performance and the overall market trend.